It’s not quite a down payment yet… but it’s a pretty sweet head start.

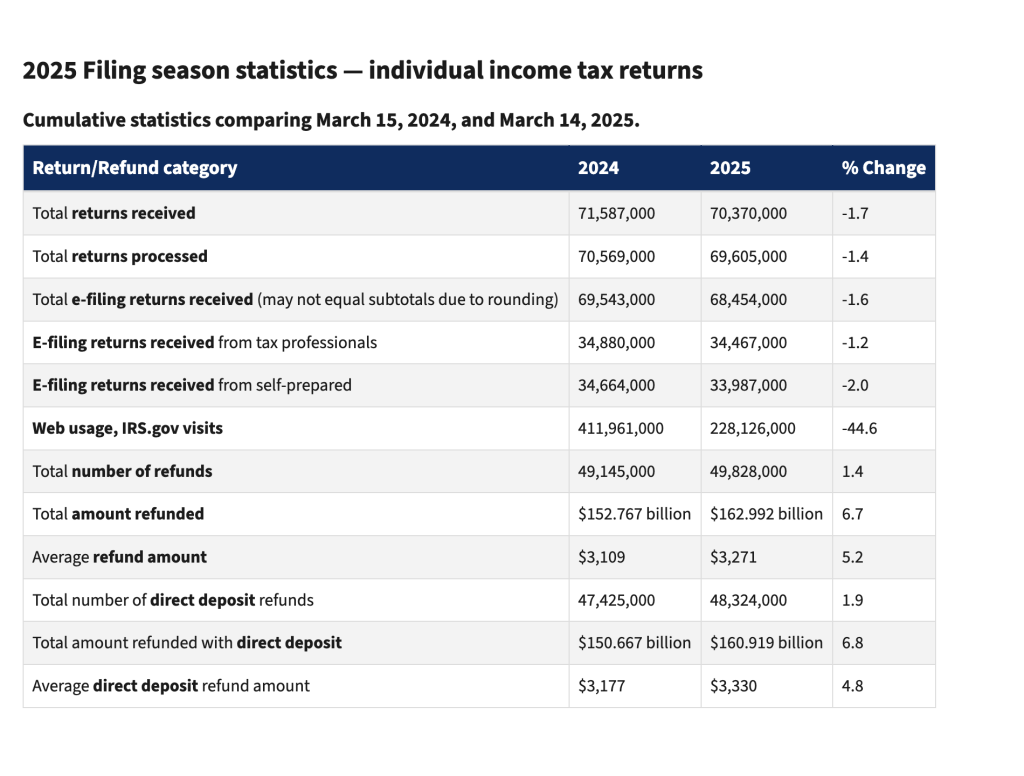

Ah, tax season. The magical time of year when the government gives you back your own money, and it somehow feels like a win. If you’re like many Americans, you’ve already received or are expecting a refund—this year’s average sits around $3,330, according to the IRS. That’s no small chunk of change, especially if you’ve got homeownership on your mind.

But before you start Zillow surfing and measuring your dog for a backyard, let’s talk about how to actually use that refund to get closer to your homebuying goals. Because while $3,000-ish won’t buy you a house outright (unless you’ve found a time machine to 1962), it can be the first smart step toward the keys to your very own front door.

Let’s break it down—with a little real talk, a few laughs, and some genuinely helpful advice.

Step 1: Know Where You Stand Before You Spend a Dime

Put the TurboTax Down and Talk to a Loan Officer First

Before you even think about spending your refund on debt or stashing it for a down payment, pause and talk to a mortgage professional. Seriously, do not pass go, do not collect 200 Zillow screenshots.

Getting pre-approved is like getting a sneak peek at your financial report card. A loan officer will look at your income, debt, credit, and assets to give you the honest truth about what you can afford—and what you need to improve.

Here’s the twist: paying off a collection account or chunk of debt might hurt your credit score in the short term. Yep. Credit score math is like common core—confusing, but somehow it works. That’s why it’s essential to get guidance from someone who knows the system. A good loan officer is like a GPS for your finances—minus the annoying “recalculating” voice.

Step 2: Build a Sexy-Looking Savings Account

Because Banks Like It When You Look Responsible

Here’s a pro move: take your refund and open a separate high-yield savings account labeled “Home Fund.” Name it that. Literally. Lenders like to see financial discipline, and nothing screams “I’ve got my life together” like a clean, growing savings account.

Plus, it builds your own confidence. You’ll feel a little more legit when you start house-hunting knowing you’ve already started building your down payment stash.

Think of it like putting gym clothes in your closet to look like you work out… except this one actually helps you buy a house.

Step 3: Down Payments and Other Grown-Up Words

Stretch That Refund Like It’s on a Budget Yoga Retreat

While your refund may not fully cover a down payment, it could still make a meaningful dent—and that’s a bigger deal than you might think. Every dollar counts when you’re saving for a home. Whether it’s $3 or $3,000, each contribution inches your buying power forward and could help you qualify for better mortgage terms.

You could also consider using that refund for something called a rate buydown or mortgage points. This is where you pay a little more upfront to lower your interest rate for the life of the loan. Translation: lower monthly payments, more money in your pocket long-term.

Mortgage points aren’t like credit card points. You don’t get a toaster—you get thousands of dollars in savings. Arguably better.

Step 4: Be the Buyer Lenders Love

Use That Refund to Polish Your Financial Resume

Still in the prep phase? Awesome. This is where your tax refund can quietly do some heavy lifting behind the scenes.

Maybe your credit score needs a little love. Use part of that refund to work with a credit counselor or a reputable financial advisor. They can help you clean up errors, prioritize which debts to tackle (yes, there’s a strategy), and boost your score in a way that actually helps you qualify for a mortgage. Think of it like giving your financial résumé a professional glow-up. You’re not just “spending money”—you’re investing in getting a better deal on the biggest purchase of your life.

Don’t sleep on homebuyer education courses, either. These aren’t just for spreadsheet-loving real estate nerds—they can actually unlock serious perks like down payment assistance, first-time buyer grants, or exclusive lender incentives. Some programs even require you to complete one to qualify.

Best part? Many of these courses are super affordable—like $50 to $100—and can potentially lead to thousands in benefits. That’s like buying a scratcher ticket and actually winning… except with less glitter and more equity.

And hey, let’s not forget about YouTube University—aka the endless sea of real estate and finance videos online. If your budget is tight, there’s a ton of free info out there. Just make sure you vet who you’re watching. Not every guy in front of a whiteboard or luxury car is a trustworthy guru. Look for licensed professionals or creators with solid credentials and reviews. Think less “get-rich-quick” and more “slow-and-steady wins the mortgage.”

Whether you’re paying for a course or binging free content, education is one of the smartest ways to use your refund—and it’ll serve you long after you’ve hung your first ‘Home Sweet Home’ sign.

Step 5: Prep for the Sneaky Costs You Didn’t See Coming

It’s Not Just the Down Payment, Friend

Even after you’ve been approved and found your dream home, there are still “surprise” costs waiting to greet you like pop-up ads.

Earnest money deposits, inspections, appraisals, and closing costs can add up fast. Using your tax refund to cover these can be a game-changer.

Here’s a rough breakdown:

- Home inspection: $300–$500

- Appraisal: $400–$700

- Earnest money: 1–3% of the purchase price (usually credited back to you, but you still need it up front)

Buying a house is like planning a wedding—there’s always some mystery fee no one warned you about.

Step 6: Make Sure You’re Not House-Rich, Cash-Poor

Keep a Cushion or You’ll End Up Sleeping on It

We get it. You want to spend every last dollar on the home itself. But hear us out: don’t.

Keep some of that refund in reserve. Why? Because real estate is messy. Closings get delayed. Sellers throw curveballs. That roof you thought looked solid suddenly springs a leak.

Having a little emergency fund will save your bacon more than once. Plus, it gives you leverage. You can act fast if something changes, and you’ll sleep better knowing you’re not one unexpected bill away from financial panic.

Call it your “Homebuying Oh-Crap Fund.”

Step 7: Not Ready Yet? That’s Totally Fine (and Smart)

Refunds Make Great Launch Pads, Not Magic Wands

If homeownership is still a year or two off for you, don’t worry—you’re not behind. In fact, using your refund to prepare early puts you ahead of most.

You can use this year’s refund to:

- Boost your credit score

- Save for next year’s down payment

- Start meeting with agents or lenders to get familiar with the process

- Take a homebuying course now so you’re ready when it’s go-time

Today’s planning leads to tomorrow’s keys.

Step 8: Real Talk—What NOT to Do With Your Refund

No, You Don’t Need a Giant Sectional Yet

Let’s get this out of the way: your refund is not the time to buy that ultra-deep, $2,000 couch you saw on TikTok. Nor is it the time to book a “treat yourself” weekend in Vegas or upgrade your TV to stadium size.

Those things are great. But they’ll still be around after you’ve bought your home.

The smartest buyers keep their eyes on the prize—and that prize is long-term stability, equity, and a home that’s actually yours.

Trust us, your future self (sitting on a moderately comfy couch in a home you own) will thank you.

Final Thoughts: Your Tax Refund Isn’t a House… But It Could Be the Front Door

Look, your refund isn’t a magic key that opens the front door of your dream home. But it is a powerful tool. And when used smartly—with a little planning and maybe some help from a pro—it can get you a whole lot closer to the goal.

So whether you’re starting from square one or halfway there, let this tax season be the moment you take one solid step forward. Open that savings account. Book the meeting with a lender. Sign up for the homebuyer course.

It’s not exactly HGTV money… but it’s enough to get the ball rolling. And that’s how every great homeownership story begins.